The wheel strategy is an income-generating approach involving selling put options, potentially owning stock, and selling covered calls. It's aimed at generating income before and possibly during stock ownership, without the primary goal of owning the stock.

This strategy consists of selling cash-secured put options and, if assigned stock, selling covered calls. It's an active approach to passive investing, suitable for investors transitioning from stock to options trading.

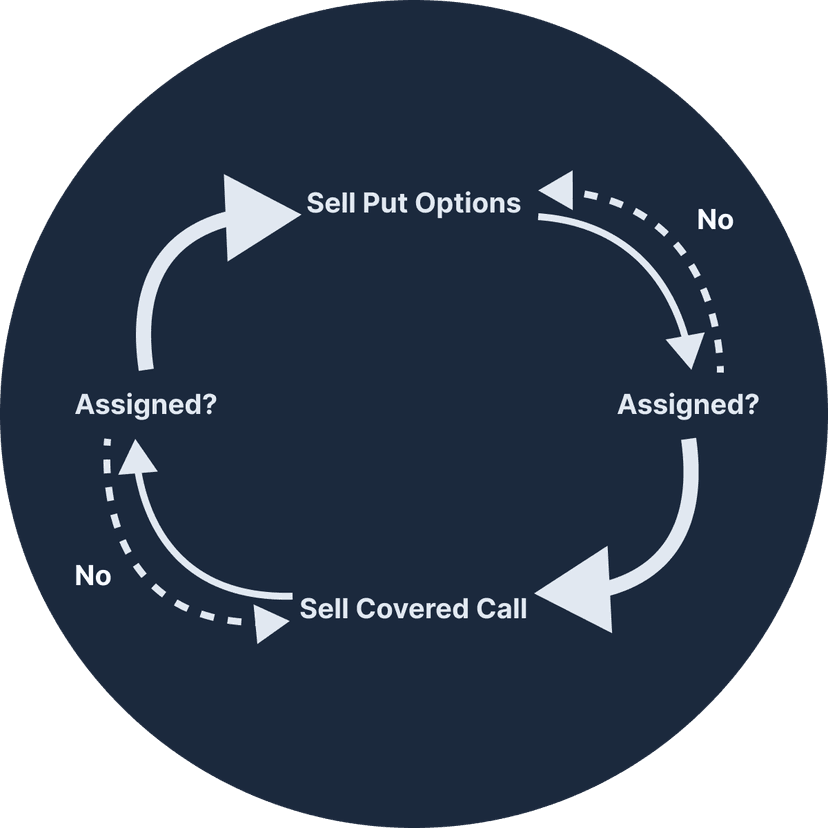

Sell put options on stocks you wouldn't mind owning at a price you're comfortable with. If the put expires worthless, you keep the premium. If assigned, sell covered calls until the calls are assigned or you decide to sell the stock.

- Start by selling a cash-secured put option.

- If assigned stock, sell a covered call.

- Repeat the process to continue generating income.

The wheel strategy requires careful selection of stocks and strike prices. It's ideal for stocks you're bullish on and willing to own, ensuring a strategy aligned with your investment goals and risk tolerance.

- Sell Put Options: Choose a stock, sell put options at or below the current market price, and collect the premium.

- If Put Options Are Exercised (Stock Assigned):Acquire stock at the strike price and benefit from owning it.

- Sell Call Options: Sell call options on the owned stock to generate additional premium income or sell the stock at a profit.